Yes your heard right there are some exemptions on classification and income recognition also

first lets talk about

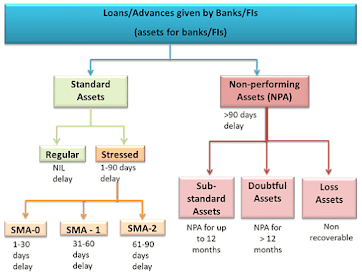

1.))Prudential norms on income recognition , asset classification and provisioning pertaining to advances

From this diagram it is clear that if interest and/or installment of principal remain overdue for a period of more than 90 days in respect of term loan or bills purchased/discounted

This is the normal guidelines but circular regarding exemption is that If Advances are guaranteed by central govt. and interest or installment in respect of those advances is overdue for more than 90days then also they will be classified as STANDARD ASSETS. condition is guarantee is not invoked or repudiated.

This is just for the purpose of classification but not recognition

Normally Non performing assets are not recorded on accrual basis but recorded in the books when amount is actually received ( cash basis)

Suppose for first two month from of granting of loan all interests and installment were received on time and therefore they were recorded by bank on accrual basis Interest is not received for 3rd month but asset is still standard asset therefore still record interest income on accrual basis and subsequently interest not received on 4th and 5th month also now from 6th month loan or advance will be treated as NPA and interest income of 3rd , 4th and 5th month will get reversed and no further income will be recorded on accrual basis.

This above whole income recognition procedure will be followed by central govt. guaranteed advances also. but hello.. this is only for central govt not state govt.

2.))HOUSING LOAN TO STAFF -

housing or similar loans are granted by bank (as a employer) to staff members where interest is payable after the recovery of principal then interest will not be considered as NPA from first quarter onward.

suppose bank granted loan of Rs. 2000000 for 5 years to staff member and it has been agreed that interest will be payable after recovery of principal amount and at the end of 5th year interest will become payable and from that period if it is overdue for period more than 90 days then that interest treated as NPA

3.))Agricultural advances affected by Natural calamities

(i) Where natural calamities impair the repaying capacity of

agricultural borrowers, as a relief measure, banks may decide on their

own to :

(a) convert the short-term production loan into a term loan or re-schedule the repayment period, and

(b) sanction fresh short-term loans

(ii) In such cases of conversion or re-schedulement, the term loan as well as fresh short-term loan may be treated as current dues and need not be classified as non performing asset (NPA). The asset classification of these loans would, therefore, be governed by the revised terms and conditions and these would be treated as NPA under the extant norms applicable for classifying agricultural advances as NPAs.

(these texts are taken from master circular by RBI )